Page 38 - SAC-Gender-Responsive-Market-Analysis-Final-Report-July-19-2021 (1)

P. 38

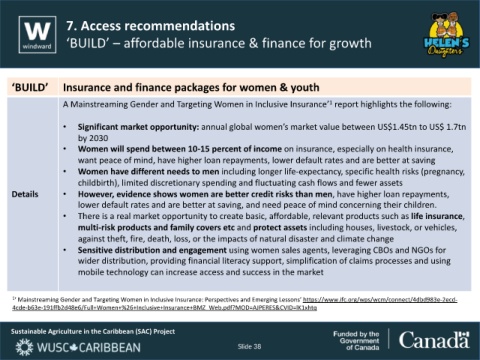

7. Access recommendations

‘BUILD’ – affordable insurance & finance for growth

‘BUILD’ Insurance and finance packages for women & youth

A Mainstreaming Gender and Targeting Women in Inclusive Insurance’ report highlights the following:

1

• Significant market opportunity: annual global women’s market value between US$1.45tn to US$ 1.7tn

by 2030

• Women will spend between 10-15 percent of income on insurance, especially on health insurance,

want peace of mind, have higher loan repayments, lower default rates and are better at saving

• Women have different needs to men including longer life-expectancy, specific health risks (pregnancy,

childbirth), limited discretionary spending and fluctuating cash flows and fewer assets

Details • However, evidence shows women are better credit risks than men, have higher loan repayments,

lower default rates and are better at saving, and need peace of mind concerning their children.

• There is a real market opportunity to create basic, affordable, relevant products such as life insurance,

multi-risk products and family covers etc and protect assets including houses, livestock, or vehicles,

against theft, fire, death, loss, or the impacts of natural disaster and climate change

• Sensitive distribution and engagement using women sales agents, leveraging CBOs and NGOs for

wider distribution, providing financial literacy support, simplification of claims processes and using

mobile technology can increase access and success in the market

1 ‘ Mainstreaming Gender and Targeting Women in Inclusive Insurance: Perspectives and Emerging Lessons’ https://www.ifc.org/wps/wcm/connect/4dbd983e-2ecd-

4cde-b63e-191ffb2d48e6/Full+Women+%26+Inclusive+Insurance+BMZ_Web.pdf?MOD=AJPERES&CVID=lK1xhtq

Sustainable Agriculture in the Caribbean (SAC) Project

Slide 38